We encrypt data at REST, even if you don't. We support your existing authentication system; Auth2, 2FAs, JWT Authentication Method, MFA, and more.

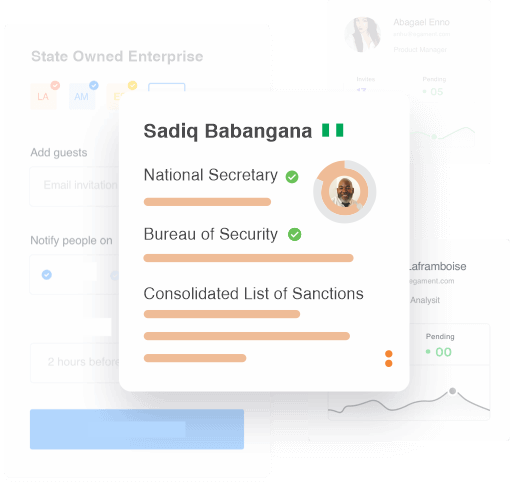

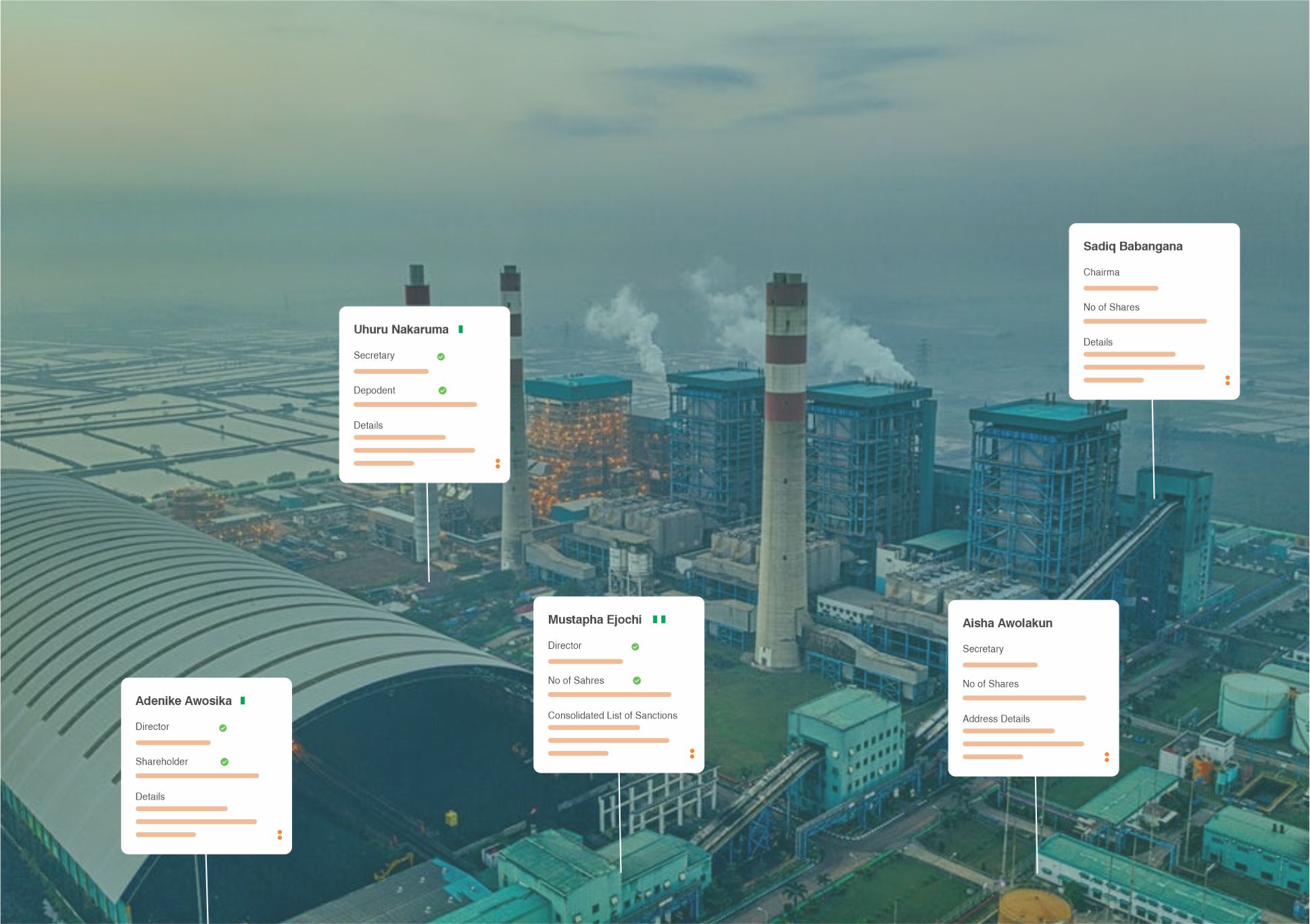

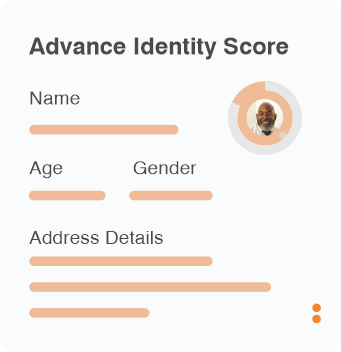

Identity Verification.

Swiftend leverages a certified framework for KYC

verification and relies on secured, up-to-date, and authentic data.

Our KYC verification service is simple and quick, ensuring compliance with

AML and KYC regulations to prevent fraud and money laundering through best practices.